Background:

As we are all aware, Prisma DAO experienced an exploit on March 28th, that caused a loss of approximately $12m and led to the protocol being paused. Since then, the DAO has voted to resume the protocol, and to reduce mkUSD fees paid out to vePrisma lockers by 50%.

As of now, the stolen funds have gone through a mixing service, and the attacker has been identified by ZachXBT as being involved in other blackhat exploits. So, it falls on the DAO to decide how to proceed.

Currently (at time of writing), the Prisma fee receiver contract holds 1,763,195 mkUSD and 1,801,895 PRISMA, combined worth approximately $2m.

It would not be in the DAO’s best interest to market sell PRISMA tokens, as the price has greatly suffered as a result of this exploit, and further devaluing the token reduces the protocol’s ability to continue to earn fees to eventually recover the current $10m shortfall.

It is also not possible to spend the entirety of the mkUSD in the fee receiver at once, as vePrisma lockers are due $80k per epoch from this contract.

Motivation:

There has been lots of feedback in the discord channel regarding the best path forward. The goal of this proposal is to combine some of these ideas to create an expedient reimbursement plan for affected users. If we were to redirect the 50% of fees (80k mkUSD) from vePrisma to purchase ETH for affected users, it would take nearly 3 years to complete at current ETH prices, and could be much longer if ETH market increases in value.

Every day that goes by is lost opportunity for the affected users who would otherwise be receiving rewards APR, or able to make use of their funds in other ways.

It would be in the best interest of the DAO to make affected users whole as soon as possible, to restore faith in the protocol and to allow the protocol to continue to grow. I believe this can be accomplished much sooner by tokenizing compensation claims, and offering PRISMA emissions in addition to ETH payments.

Many users still have confidence in the project, and I believe there would be demand to purchase tokenized positions. This would provide liquidity to allow affected users to be made whole sooner. It would also boost confidence in the protocol, which is essential for paying back victims and for the long-term success of Prisma.

Proposed Course of Action:

-

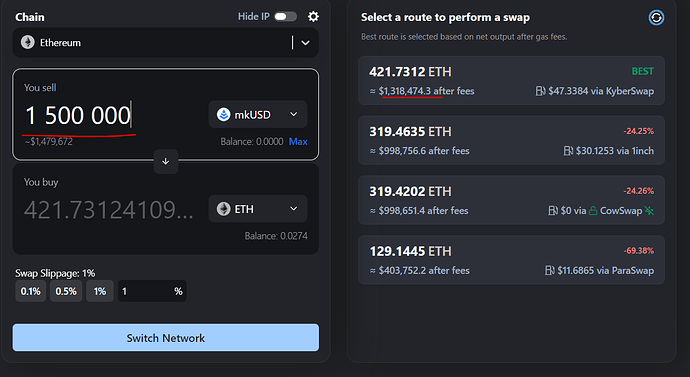

Create an immediate swap of mkUSD for ETH, to be distributed to affected users as soon as initial vote has passed. This is important, as affected user tranches are close to being at risk of liquidation.

-

Tokenize remainder of losses as a new mkPAY token. This would allow affected users to choose to hold and receive payouts, or to sell their mkPAY tokens to confident parties who are willing to speculate on the future ETH payments and prisma emissions.

-

Swap an allocation of mkUSD to ETH each epoch from the fee receiver, to be used as a streaming claim to mkPAY token holders. The swap mechanism would be a contract that uses an ETH price oracle to allow MEV to facilitate the tx automatically each week, to allow for trustless dependable payments. This same method is already being used for converting LST redemption fees into ETH.

-

Add mkPAY contract as a PRISMA emission receiver.

-

Allocate a DAO decided amount of PRISMA tokens as vote incentives, to ensure the contract receives weekly emissions.

-

Create UI page breaking down the current status of the mkPAY contract, remaining debt to be paid, and the current weekly budget for mkUSD to ETH swaps.

The ETH would be considered payment towards principal, while the PRISMA emissions would be to make up for lost opportunity, and to create demand for secondary market buyers to purchase mkPAY tokens from affected users.

The DAO would be able to vote on the weekly budget for mkUSD ETH swap and for PRISMA vote incentives, to adjust for market and protocol conditions if needed.

- If funds are recovered from attacker at any time, hold a vote to complete repayment to mkPAY holders, disable transfers to prevent secondary orders (that were placed before repayment) from being filled, and to decide when to end prisma emissions.

** Debt obligation is directly linked to the mkPAY token. Selling or transferring the token forefeits any future claim rights (beyond what is earned before time of transfer), as those rights are transferred along with the token.

Proposed Budget:

It will be up to the DAO to decide the budget for the mkUSD to ETH swaps, and for the PRISMA vote incentives.

I recommend 250k mkUSD for step 1 initial repayment, and a budget of 100k mkUSD and 10k PRISMA per epoch, to be revisited every 3-6 months to adjust for market and protocol conditions, as deemed necessary by the DAO.

Summary, and secondary market considerations:

By tokenizing positions of affected users, we can expedite the reimbursement process, and restore faith in the protocol. This would allow affected users to potentially be made whole much sooner through secondary market sales of mkPAY tokens, and would allow the protocol to continue to grow and recover from the exploit.

It allows confident users to speculate on mkPAY tokens remaining value and to make secondary market offers to affected users who may need immediate liquidity.

Due to the nature of mkPAY tokens, it would not be well suited for AMM markets, for multiple reasons. Since it is a debt bearing token, AMM markets would not be able to claim any payments. In addition to this, affected users are not explicitly making the choice when to buy or sell in an AMM format. If the receiver were focused around an LP token, it would create an opportunity for LP depositors to siphon payments from affected users.

To prevent AMM contracts or other defi contracts from earning payments that cannot be claimed, it is recommended to create a contract allow-or-deny list for streaming payments. This would allow the DAO to limit which smart contracts are eligible, to prevent claims from being allocated to contracts that are unable to claim them.

Fill-or-kill limit orders, such as those offered by Cowswap, are a much better fit for this type of token. This would allow affected users to set a price they are willing to sell at and to receive immediate payment if a buyer is willing to pay that price. This would also allow buyers to set a price they are willing to pay, and to receive delivery of the mkPAY tokens if a seller accepts their offer.

Payments and emissions claims stream to the wallet holding the tokens, so fill-or-kill markets that allow users to retain custody are recommended. This way, a token holder may sell their token, and then claim any remaining payments or emissions that are due to them, while the purchaser immediately begins accruing payments and emissions at time of sale. This also allows for the DAO to distribute mkPAY tokens directly to affected users, without the need to stake or lock.

The mkPAY contract will also include a burn function, so that if the DAO ever votes to offer secondary market liquidity, any DAO acquired tokens can be burned, and the total outstanding debt can be lowered.

Disclosure: I am a dev for Votium, and this proposal includes a budget for vote incentives. The DAO can decide whether to use Votium, Hidden Hand, or a combination of both based on which platform is expected to offer better efficiency each epoch. I am a vePrisma, and vlCVX holder, but I am not one of the affected users of the security incident.

Please post feedback and any suggestions or concerns, as this is an important decision for the DAO to make, and all deserve to be heard. Thank you.