Title: Increase Max Debt from wstETH to 200m mkUSD

Author: Prima Risk

Date: 02-11-2023

Summary:

As the max debt from wstETH has reached the 100m mkUSD limit, we propose to increase the max debt for this collateral to 200m.

Abstract:

This proposal seeks feedback from the Prisma community to increase the max debt for wstETH. Although the PRISMA token and Prisma DAO were recently launched, vote weighting is based on the previous epoch, meaning the Prisma team technically retains control of the protocol until next Thursday. In this case, we propose to conduct a Snapshot vote that the Prisma team will execute, assuming there is community approval for this proposal. As of next week, all votes will be conducted on-chain.

Motivation:

We have previously reviewed wstETH in our Collateral Risk Assessment: wstETH report. Our conclusion was that wstETH exhibits some of the strongest risk parameters of all LSD assets we have reviewed and that it would be advisable for Prisma to establish this asset as a core collateral type. There has apparently been a huge demand for wstETH as collateral, as it has the highest debt ceiling of all vaults already and was the first to hit its max debt limit. It is highly liquid on several DEXs in both the stETH and wstETH pairings. Therefore we believe a substantial increase to max debt from 100m to 200m is suitable.

Specification:

The parameter change is executed through the wstETH TroveManager contract by calling:

function setParameters(

uint256 _minuteDecayFactor,

uint256 _redemptionFeeFloor,

uint256 _maxRedemptionFee,

uint256 _borrowingFeeFloor,

uint256 _maxBorrowingFee,

uint256 _interestRateInBPS,

uint256 _maxSystemDebt,

uint256 _MCR

)

with parameters:

setParameters(999037758833783000,

5000000000000000,

1000000000000000000,

5000000000000000,

50000000000000000,

317097919837645865,

[MAX_SYSTEM_DEBT],

1100000000000000000)

where MAX_SYSTEM_DEBT = 200000000e18

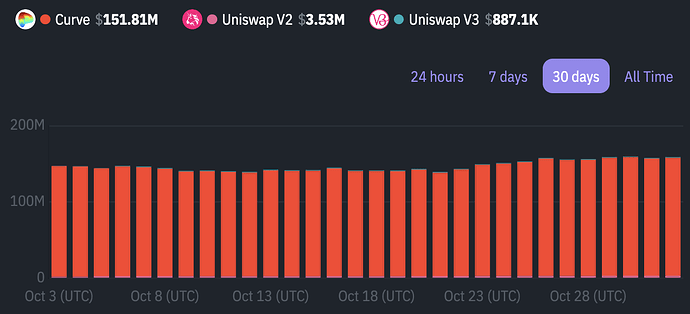

Both stETH and wstETH have exhibited healthy liquidity trends over the past month with total stETH liquidity on DEXs (predominantly Curve stETH/ETH and stETH/ETH-ng pools) increasing from $147.84m to $154.62m:

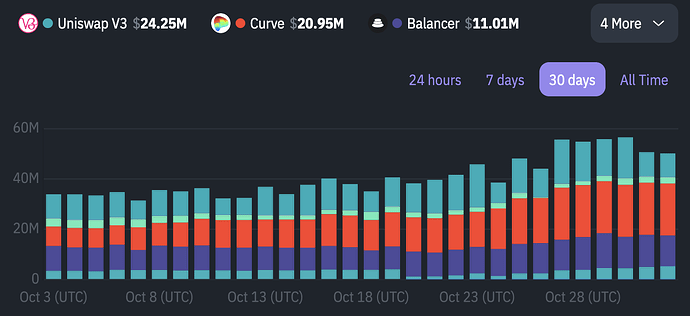

source: Dex.guruAnd total wstETH liquidity on DEXs (distributed across Uniswap, Curve, Kyberswap, Balancer, and Pancakeswap) increasing from $33.95m to $50.19m:

source: Dex.guru

Benefits (Pros):

Increase mkUSD supply from wstETH which is the sector leader with the deepest liquidity and has the strongest risk profile of all LSD assets reviewed by Prisma Risk.

Downside (Cons):

Setting max debt from wstETH too high can increase the risk of destabilizing the protocol during extreme market events that deplete mkUSD in the stability pool.

Voting: