Summary

This proposal is to extend the engagement with Llama Risk for 6 months, which will include previous services + additional risk simulation for parameterization and monitoring.

Llama Risk has been serving Prisma since June 2023 thanks to the generous support from the founding team. Its funding will expire EOY 2023 and we are requesting to continue our funding for a 6 month period from January to July 2024.

We are requesting 90,000 mkUSD for services through this time period. A 3-of-5 multisig will be responsible for custody and distribution of the grant funds.

Multisig address: 0xa2482aA1376BEcCBA98B17578B17EcE82E6D9E86

| Signer | Address |

|---|---|

| Wormhole | 0x49cE85E1c55cb5b41b8Da2Db85826E3b63A47E00 |

| Knows | 0x08f963BF8d9D8Ad3a803BDE87A0718dd25eeEac8 |

| Amadeo | 0x4c47b2520E9f7E3da15dF09718d467f783b03858 |

| Mimaklas | 0xf7Bd34Dd44B92fB2f9C3D2e31aAAd06570a853A6 |

| Philippe | 0x05A16D90f804C3e83B10bC34a480c74Cd5033C7E |

Links:

- Twitter: https://twitter.com/LlamaRisk

- Substack: https://cryptorisks.substack.com/

- Llama Risk HackMD: HackMD - Collaborative Markdown Knowledge Base

- PrismaRisk HackMD: HackMD - Collaborative Markdown Knowledge Base

Who We Are

Llama Risk began as a service to support Curve DAO voters and to protect LPs in its pools. We have since expanded to work with Prisma Finance on collateral onboarding in anticipation of the protocol’s launch earlier this year. This was a natural partnership, since Prisma has a deep connection with Curve in terms of being its primary liquidity venue and adopting some design features pioneered by Curve.

In our work to date with Prisma, our team has developed a comprehensive collateral risk framework for use with LSTs. Applying that framework, our team of analysts regularly investigate LST protocols for suitability to onboard as collateral. We publish our research of these protocols publicly on the PrismaRisk HackMD with detailed descriptions of the protocol design, performance analysis and assessment of various risks ranging from technical, market, and counterparty risks. We strive to be an objective and thorough source of information for trove owners and DAO voters; in a space that can be highly susceptible to financially motivated biases, we seek to cut through the noise, maintaining the interest of Prisma and its users as our highest priority.

Since we began our engagement with Prisma, it has matured as a protocol with an established set of collateral types, integrations with various liquidity pools, and deployment of the DAO and PRISMA token. Therefore, we are interested in shifting our focus to managing risk and optimizing parameters for the protocol. This will involve development of risk modeling tools for assigning optimized parameters and identifying potentially unsafe conditions before any crisis emerges. This new service offering will be in addition to our comprehensive reports, although we intend to shift our attention toward monitoring and parameterization tools.

To comment more generally on the overall goal of our work: we strive to build confidence by providing tools and services that offer sensible guidance, and to convert confidence into adoption. Prisma DAO should be confident that the system is optimized to reduce the possibility of bad debt and maximize growth potential. Prisma’s users should be confident that Prisma is a safe place to park their capital and that they have access to all relevant information about the risks involved. Prisma’s partners should be confident that their partnership is valued and that Prisma is taking an interest in protecting their own users. In all cases, confidence is a product of placing a top priority on Prisma’s users, on doing everything in our power to strengthen assurances to our users.

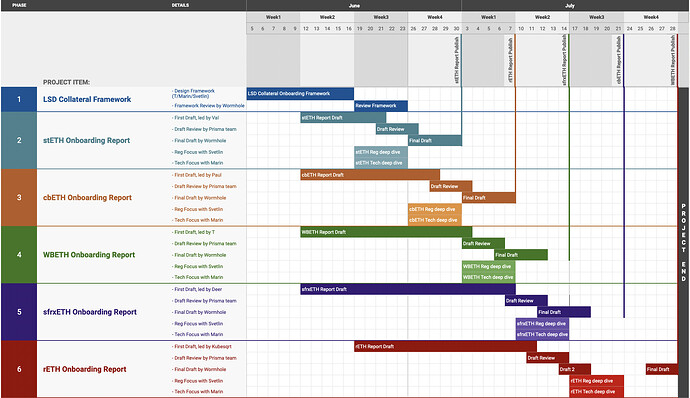

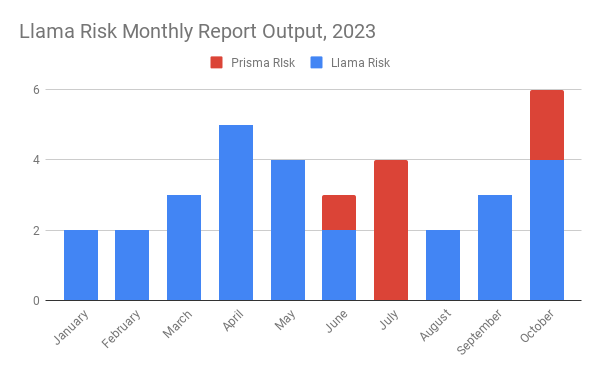

Llama Risk: 2023 Review

Our engagement began in June 2023 in anticipation of the Prisma protocol launch. The team requested risk assessment services for the purpose of onboarding an initial basket of collateral assets. This project involved development of a comprehensive LST collateral risk framework and a thorough report for each of the 5 collateral assets being considered (wstETH, rETH, sfrxETH, cbETH, and WBETH). The project required extensive management, since there was a strict deadline to produce the reports before protocol deployment and much of the work would involve simultaneous investigation by multiple risk analysts. The timeline of the project is shown below:

In addition to the initial collateral basket project, our original engagement with Prisma included a retainer for a 6 month period through the end of year 2023. Services included continuous consultation on onboarding and collateral risk management, and to produce reports for additional collateral assets being considered for onboarding. We have additionally produced comprehensive reports for Swell swETH, Origin WOETH, and Stader ETHx. We have been active in consultation and in governance discussion around setting suitable parameters for various vaults with regard for the health of the protocol and the collateral asset. We have also produced a risk report for mkUSD, published on our Substack, that was not directly within the scope of our engagement but is suitably aligned with our mission to provide transparency for users.

Another noteworthy contribution we have made, pertinent to the new risk modeling services we hope to provide in the coming year, is a hackathon project we have recently submitted. We developed a PoC circuit breaker tool for the Chainlink Constellation Hackathon that monitors the health of the Prisma protocol and the health of the collateral asset to determine if unsafu conditions have been met.

The “circuit breaker” component of the design was an exercise for the hackathon, but our primary motivation was to begin an analysis of the Prisma protocol to design data-driven risk models custom to Prisma’s design requirements. Our experience is setting a foundation for development of more sophisticated models.

Proposal for 2024

We propose a 6 month engagement from January 1 through end of June 2024. There will be two areas of focus, described below:

Focus Area 1: Collateral Risk Reports

We will continue offering this service, as we believe our reports have been a useful contribution for the DAO. We have several teams currently requesting we publish reports on their protocols as part of their process to petition for onboarding. This includes StakeWise osETH, Ether.fi eETH, and RedStone oracle. Review of RedStone is part of our investigation into suitable oracle solutions and reducing oracle risk in Prisma. There clearly continues to be demand for risk report services, and we anticipate that more protocols will become interested in undergoing collateral risk review in the coming months.

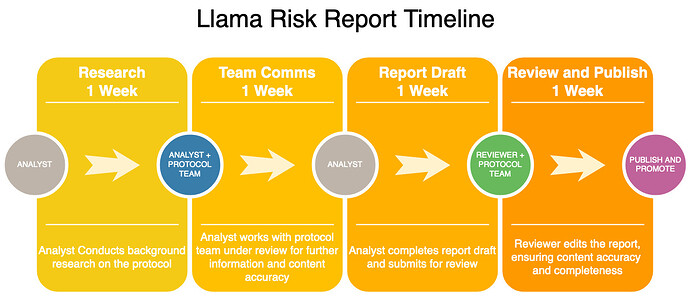

For a typical report, one analyst is assigned to research a protocol with an average timeline of 3 weeks that includes 1 week research, 1 week interfacing with the protocol team, and 1 week to complete a report draft. Finally, the report is submitted for review before publishing.

In the past 6 months, we have completed 8 collateral reports for Prisma, the majority of which were in the initial onboarding project.

We anticipate less reports in our future engagement, as most suitable LST protocols have been previously reviewed. Many early stage protocols have blockers that make them unsuitable for use as collateral, and we anticipate less opportunity to review promising protocols in the near future. We may revise our opinion on the matter in 6 months time, as the market may have developed substantially in that time. We predict for the upcoming engagement to complete 6 comprehensive reports (3 in the pipeline + 3 TBD).

Focus Area 2: Risk Parameterization Sims

We intend to devote the majority of our attention on developing tools that aid in setting suitable parameters. We identify crucial components of the Prisma system that provide insight into the health status of the protocol, combined with market data about the collateral assets. The data will be processed to recommend key parameters such as debt ceiling and MCR by collateral type.

For the risk modeling formula, we outline 5 main risk sections. These sections are subject to change, and represent our analysis of Prisma’s essential components thus far. The seven risk sections are:

- Stability pool share size in relation to mkUSD circulating supply

- Collateral onchain price impact

- Collateral volatility score

- Capital concentration risk adjustment factor

- Protocol quality score

Details about each risk scoring section are in this document but in summary:

1. Stability pool share size in relation to mkUSD circulating supply

Prisma Finance uses a Stability Pool with mkUSD as the protocol’s main backstop mechanism. The proportion of mkUSD in the pool is representative of the protocol’s resilience in case of a major liquidation event. Higher SP share in minted debt supply is an indicator that protocol is in “healthy state” and new collateral proposals can be considered. We can also add “Global Collateral Ratio” here as an additional filter.

Formula:

Stability Pool size / mkUSD outstanding supply = SP share size

2. Collateral onchain price impact

After liquidation of a Trove when CR has fallen under MCR, we need to take the assumption that SP depositors want to immediately realize profit on market. That means collateral assets need to have enough market liquidity to absorb profit realization performed by liquidators. That is measured by onchain price impact from different trade sizes.

3. Collateral volatility score

As all assets on Prisma are ETH staking derivatives, the volatility is expected to be consistent across assets. However, there may be discrepancies that require monitoring, related to depegs or black swans affecting individual LSTs.

For volatility, we use:

a) Parkinson Method (for intraday price deviation extremes)

b) EMA volatility Method

4. Capital concentration risk adjustment factor

This factor would adjust the supply cap based on the capital concentration ratio of individual collateral vaults. It measures the risk to the protocol associated with concentration of positions held in the system. We calculate the following concentration factors:

- Collateral Market TVL / Number of Troves

- Debt created by collateral / Number of Troves

- Share of 5 largest troves size / Collateral Market TVL

5. Protocol quality score

This section includes all other risks and assessment metrics not mentioned above (exclude collateral volatility, accessible liquidity, LSD issuer performance etc), employing a scoring framework based on quantifiable factors.

a)Market Size - Protocol market cap and collateral TVL (size of LSD collateral)

b) Adoption - Number of LSD token holders, supported protocols, DAO treasuries, CEXs listed, etc.

c) Network Activity - Txs volume, Number of txs, Velocity, etc.

d) Governance Decentralization - Minimum individuals (accounts) threshold required to take control over protocol

e) Smart Contract Security - Code maturity and uniqueness, developer activity, audits, bug bounties

f) Regulatory Risk - development of cryptoasset regulation framework, Possession of financial/CASP license, sanctions compliance, enforcement actions

Project Timeline

Our proposed timeline for the parameterization project would be a three month engagement divided into four phases. The bulk of the work will be assigned to a two-member team from Llama Risk, with additional consultation from a third researcher. During development of the models, we will have weekly calls with Prisma team members to provide status updates.

Upon conclusion of the engagement, we will provide Prisma with a well-tested and extensible simulation tool for parameterizing existing and onboarded collateral assets. We will ensure Prisma developers are able to apply the tool to future collateral types.

Overall Budget Request

We are requesting a budget of 90,000 mkUSD for the 6 month engagement from January through end of June. The engagement includes providing comprehensive collateral risk reports, a risk parameterization tool, and regular consultation and monitoring of the protocol health as described in the proposal.

The recipient address is the following 3-of-5 Llama Risk multisig:

0xa2482aA1376BEcCBA98B17578B17EcE82E6D9E86

It’s been a pleasure working closely with the Prisma team for the past 6 months and we hope to have the chance to continue making an impact going forward. Thank you to the Grants Council for your consideration.