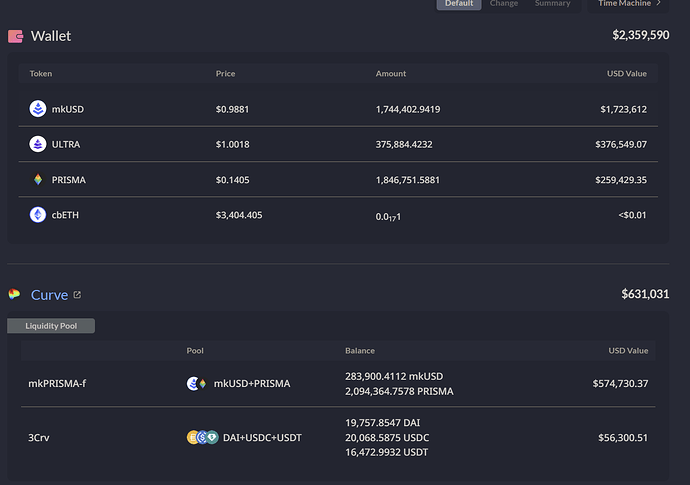

Prisma currently holds approximately $330,000 USD of ENA tokens (link) and roughly $2 million USD in the Fee Receiver (link), totaling around $2.33 million USD.

Below is brief summary of the proposal:

-

Immediate Partial Repayment: Proposing to reimburse each victim for up to 50 ETH to cover their losses in the security incident promptly.

-

Reasons for this plan:

• Restore Prisma’s Reputation: Making an immediate restitution plan in ETH to the victims using DAO’s Fee Receiver money delivers a powerful and positive signal that Prisma DAO takes care of its community and users.

• Mitigate Future Burden: ETH’s price increase will make repayment more challenging over time straining Prisma holders + the DAO, if ETH increases by 2x, so does the debt + user losses.

• Swift Restitution: Providing 50 ETH per victim ensures quick recovery for most users.

• Financial Buffer: Leaves around $400,000 USD in the treasury for ongoing operations.

-

Reasons to Avoid Tokenizing Debt:

• Past Failures: Tokenized repayment plans in similar incidents (e.g., BZx, Harvest.finance, Beanstalk) have almost all fallen short.

• Focus on Tangible Solutions: Utilize existing community assets for immediate resolution of community losses rather than speculative future revenue. -

Exploring Other Alternative Strategies:

• TommyGenesis’s Proposal:

• Potential complexity in implementation, including development overhead, UI adjustments, and contract audits.

• Questionable acceptability for debt tokens from victims.

• Simpler Repayment Mechanisms:

• Consider redirecting a % of fees to facilitate repayment.

• Prioritize ETH repayment if stolen funds are recovered.

Expanding on the Above Points of View

Here is my reasoning for repaying each victim up to 50 ETH in losses promptly below:

- Currently, Prisma’s suffering a post-incident hit in terms of its reputation. Making an immediate restitution in ETH to the victims using DAO’s Fee Receiver reserve that covers most victims delivers a powerful voice that Prisma DAO takes care of its users’ fund.

- Another reason for this immediate repayment of a larger amount is due to the likelihood of long-term ETH price rising and this will make the repayment even more of a burden for Prisma token holders & Prisma DAO as time passes, rendering it exponentially more expensive for the Prisma DAO to make victims whole. Repaying with 50 ETH per victim immediately would leave the treasury with around 400k USD and make a majority of users whole quickly.

- The Prisma DAO had raised funds prior to inception, I am assuming they are using those funds for runway from those rounds + to cover operations since there are no mention of salaries/expenses etc coming from fee receiver.

Reasons against Largely tokenizing the debt, pasted from previous comments:

It’s a STRONG & OBVIOUS case that NO tokenized recompensation plans were effective past the LEO/bitfinex centralised one, especially this is the case for DeFi protocols. BZx also tokenized losses & people determined that it would be unlikely that those losses would be repaid in any reasonable amount of time and they ended up facing a class action lawsuit.

DeFi Bad Historical Examples:

- BZx with p125 token

- Harvest.finance with grain token

- Beanstalk and their token

This model has empirically shown to never amount to even coming close to repaying their victims in nearly all historical cases. I strongly believe making a debt token sounds good in theory but works out far less than optimal in practice especially for victims.

Besides, there are other potential issues with tokenizing the repayment:

Not only his method did seem quite complex in terms of dev work/ new UI / new contracts to audit/ potentially complex to make a secondary market, but also it is questionable if there is any demand to purchase debt tokens from victims.

We should focus on doing whats possible and dispersing currently existing assets rather than anticipated future assets and revenue in the form of debt.

As for the remainder of the repayment apart from this immediate repay part to the victims, it is suitable to start the discussion to veer to TommyGenesis’s proposed tokenizing method.

It would be nice if the victims could be repaid in a simpler manner via a combination of directing fees.

Of course, ideally if the stolen funds are returned all the above + future repayment would be repaid in ETH if possible.

Immediate Repayment table by MaximumPain below:

| Addresses | Before | After | Change | wStETH Conversion Rate | Loss (in ETH) | Repay up to 100 ETH | Repay up to 50 ETH |

|---|---|---|---|---|---|---|---|

| 0x56A201b872B50bBdEe0021ed4D1bb36359D291ED | 1745.08 | 463.18 | -1281.9 | 1.1648 | -1,493.157 | -100.00 | -50.00 |

| 0xcbfdffd7a2819a47fcd07dfa8bcb8a5deacc9ea8 | 824.6 | 192.12 | -632.48 | 1.1648 | -736.713 | -100.00 | -50.00 |

| 0xc487370895f6e8f5b62d99bf1472c95a94073379 | 377.2 | 95.6 | -281.6 | 1.1648 | -328.008 | -100.00 | -50.00 |

| 0x9fceded3a0c838d1e73e88dde466f197df379f70 | 356.28 | 102.12 | -254.16 | 1.1648 | -296.046 | -100.00 | -50.00 |

| 0x1b72bac3772050fdcaf468cce7e20deb3cb02d89 | 166.41 | 47.49 | -118.92 | 1.1648 | -138.518 | -100.00 | -50.00 |

| 0x3b15cec2d922ab0ef74688bcc1056461049f89cb | 107.18 | 18.89 | -88.29 | 1.1648 | -102.840 | -100.00 | -50.00 |

| 0x16f570e93fdbc3a4865b7740deb052ee94d87e15 | 113.6 | 32.4 | -81.2 | 1.1648 | -94.582 | -94.58 | -50.00 |

| 0x4a3fced7c536e39ca5292a024ee66c9b45b257ec | 87.93 | 19.85 | -68.08 | 1.1648 | -79.300 | -79.30 | -50.00 |

| 0xf8d1c9ab49219f7acf7b1d84705e5aea3b8ce0aa | 70.3 | 17.85 | -52.45 | 1.1648 | -61.094 | -61.09 | -50.00 |

| 0xf9ca66ef84c773fab422562ab41b1ee8d4397418 | 47.3 | 15.48 | -31.82 | 1.1648 | -37.064 | -37.06 | -37.06 |

| 0xc47fae56f3702737b69ed615950c01217ec5c7c8 | 40 | 11.69 | -28.31 | 1.1648 | -32.975 | -32.98 | -32.98 |

| 0x774bb9306df1cd921eb842b1388c78f75e6ef79f | 172.18 | 149.36 | -22.82 | 1.1648 | -26.581 | -26.58 | -26.58 |

| 0x19562df3e7fd2ae7af4e6bd288b04c2c90405212 | 31.22 | 9.15 | -22.07 | 1.1648 | -25.707 | -25.71 | -25.71 |

| 0x1b004189e64d5b2f71d5be554470e6c49e10123b | 21.74 | 5.98 | -15.76 | 1.1648 | -18.357 | -18.36 | -18.36 |

| 0x3b82ee6c15b212ed69d5795bcd957e136eaa4bff | 13.02 | 3.45 | -9.57 | 1.1648 | -11.147 | -11.15 | -11.15 |

| 0x14b30b46ec4fa1a993806bd5dda4195c5a82353e | 4.22 | 1.21 | -3.01 | 1.1648 | -3.506 | -3.51 | -3.51 |

| 0x409c6c5ec5c479673f4c09fb80d0f182fcff643e | 3.8 | 0.93 | -2.87 | 1.1648 | -3.343 | -3.34 | -3.34 |

| 0x409c6c5ec5c479673f4c09fb80d0f182fcff643e | 0.93 | 0.99 | 0.06 | 1.1648 | 0.000 | ||

| 0x3b82ee6c15b212ed69d5795bcd957e136eaa4bff | 3.45 | 3.52 | 0.07 | 1.1648 | 0.000 | ||

| 0x409c6c5ec5c479673f4c09fb80d0f182fcff643e | 0.99 | 1.06 | 0.07 | 1.1648 | 0.000 | ||

| 0x19562df3e7fd2ae7af4e6bd288b04c2c90405212 | 9.23 | 9.3 | 0.07 | 1.1648 | 0.000 | ||

| 0x3b15cec2d922ab0ef74688bcc1056461049f89cb | 18.89 | 18.97 | 0.08 | 1.1648 | 0.000 | ||

| 0xf8d1c9ab49219f7acf7b1d84705e5aea3b8ce0aa | 17.85 | 17.93 | 0.08 | 1.1648 | 0.000 | ||

| 0x19562df3e7fd2ae7af4e6bd288b04c2c90405212 | 9.15 | 9.23 | 0.08 | 1.1648 | 0.000 | ||

| 0xc47fae56f3702737b69ed615950c01217ec5c7c8 | 11.69 | 11.78 | 0.09 | 1.1648 | 0.000 | ||

| Total in ETH | -3,488.937 | -993.66 | -608.68 | ||||

| Total in USD | -10,815,705 | -3,080,333 | -1,886,910 |

Exploring Other Alternative Strategies

TommyGenesis’s Proposal - Issues & Implementation Complexities:

Implementing TommyGenesis’s proposal could encounter various complexities:

- Development: Additional dev power + overhead needed to implement.

- UI Adjustments: Enhancements to user interfaces for better accessibility.

- Contract Audits: Necessary security reviews to ensure compliance and minimize risks.

- Secondary Market Creation: Creating a secondary market that needs maintenance of liquidity pools and might have little demand for buyers to step in

Acceptability of Proposed Debt Tokens:

There may be skepticism about using debt tokens as compensation, especially from victims, due to concerns over their stability and liquidity.

Simpler Repayment Mechanisms:

Redirecting Fees:

A simpler mechanism might involve using transaction or service fees to fund repayments, providing a predictable revenue stream.

Prioritizing ETH Repayment:

If stolen funds are recovered, prioritizing repayment in ETH could simplify the process and ensure value retention, especially if the original loss was in Ethereum.