Author: Sidn3yGottlieb

Date: March 8th, 2024

Summary

Given the market condition, we would like to propose significant changes to parameters of collaterals on PRISMA. The bull market as well as the arrival of Ethena has created significant demand for stablecoins and MakerDAO are proposing to raise borrow rates to over 16% across the board.

As mkUSD peg is struggling, we believe it is important for the DAO to take immediate action to raise interest rates significantly where we can and raise mint fees on tranches where the interest rate is capped to make Prisma parameters more competitive with the wider ecosystem. ULTRA’s peg is similarly struggling which is why we propose to raise IR to 20%

We realize this presents an extreme change to parameters which we believe are justified given current market conditions. Most importantly, PRISMA emissions keep compensating heavily for the high interest rates. crvUSD borrow rates are in the high 20s, MakerDAO are now going to be over 16% and those don’t have direct incentives for maintaining an open position. As a result, it’s important we bring Prisma in line with the rest of the ecosystem.

Motivation

- Bring Prisma in line with other CDP protocols

- Lower redemptions, help the peg

- Avoid further pressure

- Increase revenue

Changes

Collateral Current IR% New IR% Mint fee % New mint fee % Stable wstETH-A 4% 4% 0.75% 5% mkUSD wstETH-B 6% 15% 0% 0% mkUSD sfrxETH-A 4% 4% 0.75% 5% mkUSD sfrxETH-B 6% 15% 0% 0% mkUSD rETH 4% 4% 0.75% 5% mkUSD cbETH 4% 4% 0.75% 5% mkUSD - - - - - - weETH 6.5% 20% 1% 1% ULTRA ezETH 6.5% 20% 1% 1% ULTRA rsETH 6.5% 20% 1% 1% ULTRA

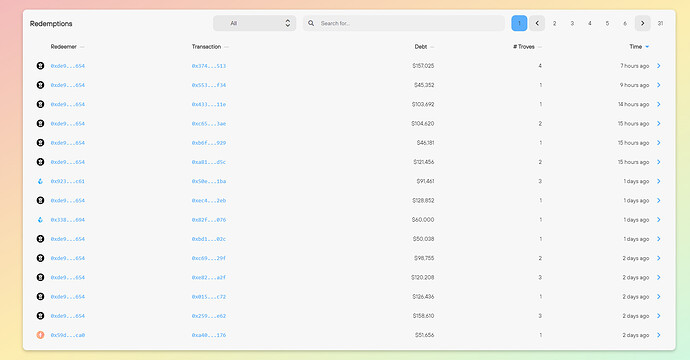

Recent Redemptions

mkUSD Price

Vote

To come next