Summary

This publication proposes revising the Debt Interest Rate from 4% to 6.5% for the new Prisma LRT troves.

Abstract

We propose increasing the Debt Interest Rate parameter from 4% to 6.5%. ULTRA borrowing is too cheap given the extra risk that the new LRT collateral weETH and upcoming ezETH and rsETH collateral to mint ULTRA.

Motivation

The 4% rate on LRT’s is in line with the minimum rate parameters for Prisma Finance’s LST CDP products. This appears a mismatch of risk/reward for Prisma to offer a lending market at these rates. LRT’s pose a higher risk than LST’s via the new nature of restaking as well as wrapped restaked eth products (LRT’s).

“Prisma has already reviewed several LRT collaterals, assessing the corresponding risk levels and determining the appropriate parameters for each”

Extra Risks of Current LRT Trove

-Slashing events from underlying restaked ETH

-Liquidity risks from smaller LP’s, the two biggest stTEH curve pools hold 350M of assets whereas the 2 biggest curve pools for weETH have 15M of liquidity

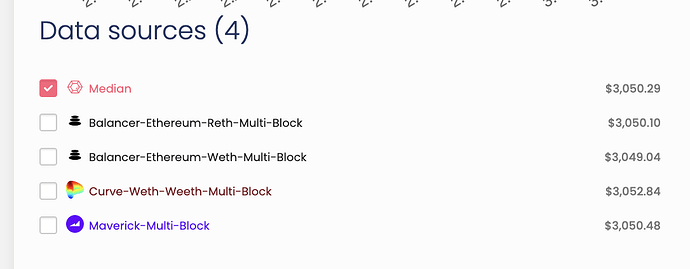

-Oracle risks from lower number of data providers

4 sources compare to the multitude that stETH has.

I believe these oracles have been assessed and deemed safe to collateralized ULTRA safely but this should not warrant a borrow rate or 4% like the higher TVL more pristine collateral of vanilla LST’s like stETH or frxETH.

The interest rate increase of 4% to 6.5% on LRT’s is unlikely to have a material effect on the use and demand of the vaults as these LRT trove creator’s are earning many times as much in real and potential yield from (ETH staking + staking + Eigenlayer points + ether. fi points + PRISMA emissions). This is still borrower friendly in comparison to the immediate 5% open fee that Gravita charges on weETH borrowing.

The bump of 2.5% would be sufficient in managing the risk for the protocol and sufficiently rewarding PRISMA holders for the extra emissions for ULTRA and its LP’s. The added benefit of higher rates will lower the risk of redemptions for LRT troves which on average are sitting at 170% Collateral Ratio.

The proposed debt interest rate is of course up to debate but 6.5% is reasonable and still inline with Maker/Spark rates for LST borrows.

Leaving Mint fee at 0.75% is reasonable and sufficient in order to drive adoption of ULTRA for the time being.

Specification

Update the Debt Interest Rate as followed:

| Parameter | Current Value | Proposed Value |

|---|---|---|

| Debt Interest Rate (ULTRA) | 4% | 6.5% |

| Mint Fee (ULTRA) | 0.75% | 1% |

Closing Remarks

I hope this proposal can open up further discourse on how interest rates can be managed for newer collateral types and the safety of the protocol and borrowers. Thank you for reading and would be happy to hear any comments, concerns, suggestions.