Summary

Raise the amount distributed weekly to vePRISMA holders

Motivation

We initially decided to be conservative in the mkUSD amount being distributed weekly as most of the revenue comes from debt interest rate which we thought might need lowered in the future. However, as demand to borrow stablecoins has remained high with most rates above 10% on protocols like Curve and AAVE, we believe those higher interest rates are here to stay.

80% / 20% Split

We propose no change to this split which is as follow:

- Any LST fees will be sold for mkUSD (our preference would have been to distribute the LSTs direclty but gas on mainnet makes that prohibitive)

- Up to 160k mkUSD from the feereceiver will be distributed weekly (this is a parameter that can be modified)

- Another 40k mkUSD will be paired with $40k PRISMA and added to the mkUSD/PRISMA pool weekly (the LP position will be owned by the DAO in perpetuity)

- Remaining PRISMA in the fee receiver will remain there for now

- If there is less than 200k mkUSD in the fee receiver, 80% of the mkUSD would be distributed to vePRISMA holders and the remaining 20% will be added to the mkUSD/PRISMA pool

- The cap can be adjusted. If the protocol kept growing rapidly and its revenue exceeds expectation, the DAO could change it.

Changes

- Amount distributed to vePRISMA holders goes from $100k to $160k

- Amount to be LP’d in the mkUSD/PRISMA pool goes from $25k to $40k

- vePRISMA APR goes from 19% to 30.4% (variable)

Data

Fee receiver address on etherscan

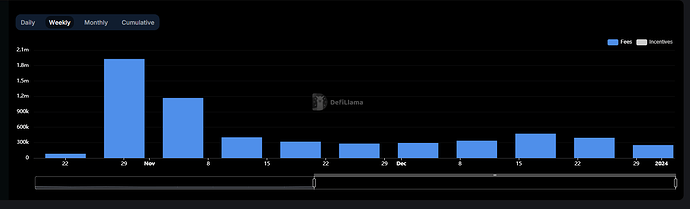

Fees since launch (from DeFiLlama)